All About Top 30 Forex Brokers

All About Top 30 Forex Brokers

Blog Article

Examine This Report about Top 30 Forex Brokers

Table of ContentsTop 30 Forex Brokers Can Be Fun For EveryoneTop 30 Forex Brokers for DummiesExcitement About Top 30 Forex BrokersThe smart Trick of Top 30 Forex Brokers That Nobody is DiscussingA Biased View of Top 30 Forex BrokersAn Unbiased View of Top 30 Forex BrokersThe smart Trick of Top 30 Forex Brokers That Nobody is Discussing10 Simple Techniques For Top 30 Forex Brokers

Like various other circumstances in which they are used, bar charts supply more rate information than line charts. Each bar graph stands for someday of trading and has the opening cost, highest price, most affordable cost, and closing cost (OHLC) for a trade. A dashboard on the left stands for the day's opening rate, and a similar one on the right represents the closing price.Bar graphes for currency trading aid investors determine whether it is a purchaser's or vendor's market. Japanese rice investors first made use of candle holder charts in the 18th century. They are aesthetically much more appealing and simpler to read than the graph kinds explained above. The upper portion of a candle light is used for the opening rate and highest price factor of a currency, while the lower portion suggests the closing rate and cheapest rate point.

Not known Facts About Top 30 Forex Brokers

The developments and forms in candlestick graphes are made use of to determine market direction and activity.

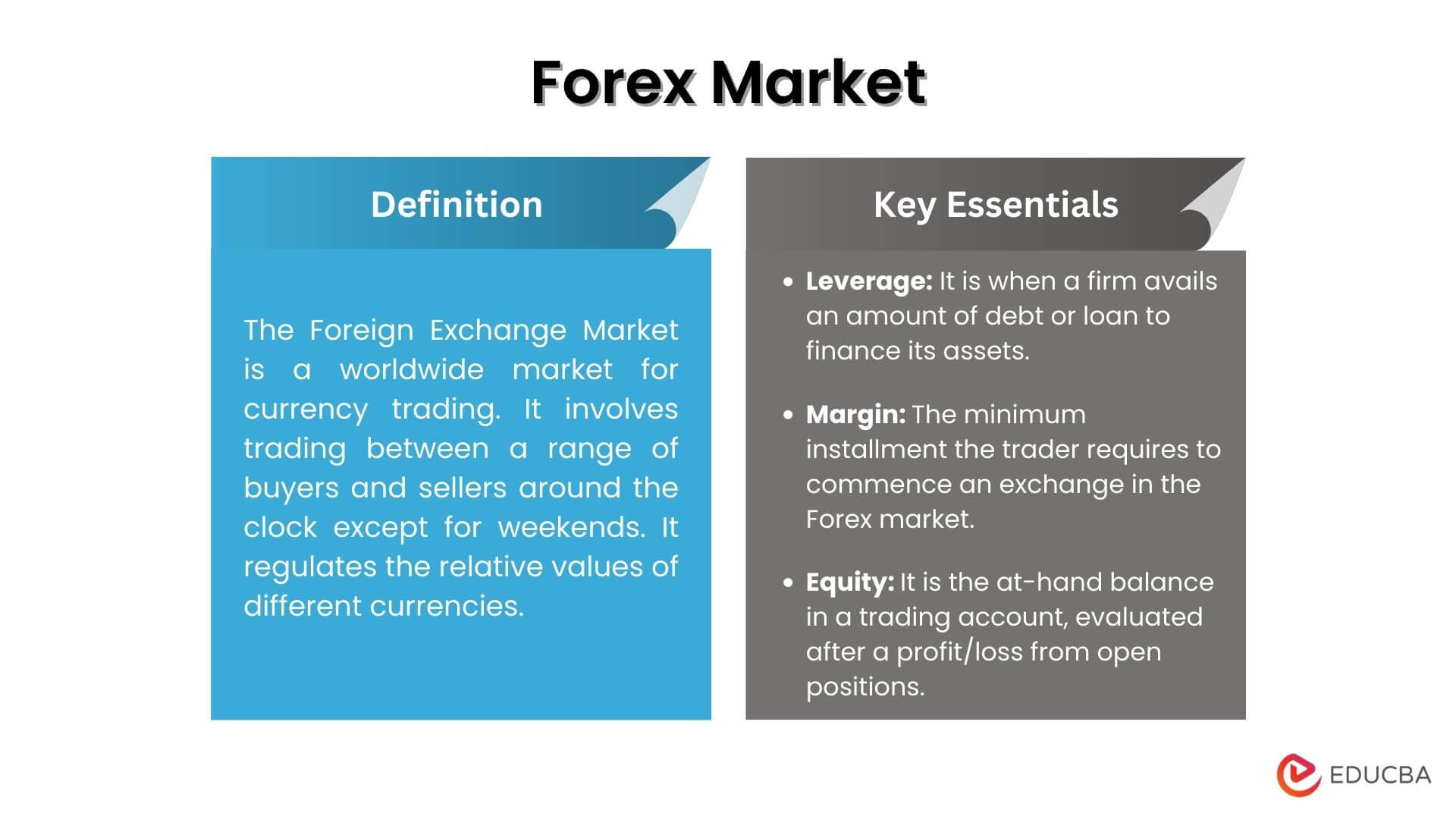

Banks, brokers, and suppliers in the forex markets enable a high quantity of leverage, implying investors can manage large positions with fairly little cash. Take advantage of in the array of 50:1 is common in foreign exchange, though even higher quantities of utilize are offered from particular brokers. Leverage must be made use of meticulously since numerous unskilled traders have endured considerable losses using even more leverage than was essential or prudent.

How Top 30 Forex Brokers can Save You Time, Stress, and Money.

A money trader requires to have a big-picture understanding of the economic climates of the numerous countries and their interconnectedness to realize the principles that drive currency values. The decentralized nature of forex markets means it is less controlled than other economic markets. The level and nature of policy in forex markets depend upon the trading territory.

The volatility of a certain money is a feature of multiple aspects, such as the national politics and business economics of its nation. Events like financial instability in the kind of a payment default or discrepancy in trading relationships with an additional currency can result in substantial volatility.

The Buzz on Top 30 Forex Brokers

The Financial Conduct Authority (https://www.awwwards.com/top30forexbs/) (FCA) displays and controls forex trades in the United Kingdom. Money with high liquidity have a prepared market and show smooth and predictable price activity in response to exterior occasions. The united state dollar is one of the most traded money on the planet. It is paired in six of the market's 7 most fluid currency pairs.

The Single Strategy To Use For Top 30 Forex Brokers

In today's details superhighway the Forex market is no much longer exclusively for the institutional investor. The last 10 years have actually seen an increase in non-institutional traders accessing the Forex market and the benefits it uses.

Things about Top 30 Forex Brokers

Fx trading (foreign exchange trading) is an international market for purchasing and marketing currencies. At $6. 6 trillion, it is 25 times bigger than all the globe's stock exchange. Foreign exchange trading determines the currency exchange rate for all flexible-rate money. As a result, prices transform regularly for the currencies that Americans are more than likely to use.

When you offer your money, you receive the settlement in a various currency. Every traveler that has gotten foreign currency has done forex trading. The investor purchases a specific money at the buy rate from the market manufacturer and markets a different currency at the marketing rate.

This is the transaction cost to the trader, which consequently is the profit earned by the market maker. You paid this spread without recognizing it when you exchanged your dollars for international money. You would certainly discover it if you made the transaction, terminated your journey, and after that tried to trade the money back to dollars right now.

Top 30 Forex Brokers - Questions

You do this when you assume the currency's worth will certainly drop in the future. Services short a money to safeguard themselves from threat. But shorting is extremely high-risk. If the money climbs in worth, you need to acquire it from the dealer at that price. It has the same advantages and disadvantages as short-selling stocks.

Report this page